The Definitive Guide for Medicare Graham

Searching for the best Medicare plan can be a little difficult, yet it does not need to be made complex. It's all regarding being well-prepared and covering your bases. You intend to begin your journey as notified as possible, so you can make the finest option - Medicare Near Me. This implies asking the best questions concerning insurance coverage, Medicare plan networks and doctors, plan advantages and more.

Before we speak about what to ask, allow's speak regarding that to ask. There are a great deal of methods to authorize up for Medicare or to get the details you need prior to selecting a plan. For lots of, their Medicare journey begins directly with , the main web site run by The Centers for Medicare and Medicaid Services.

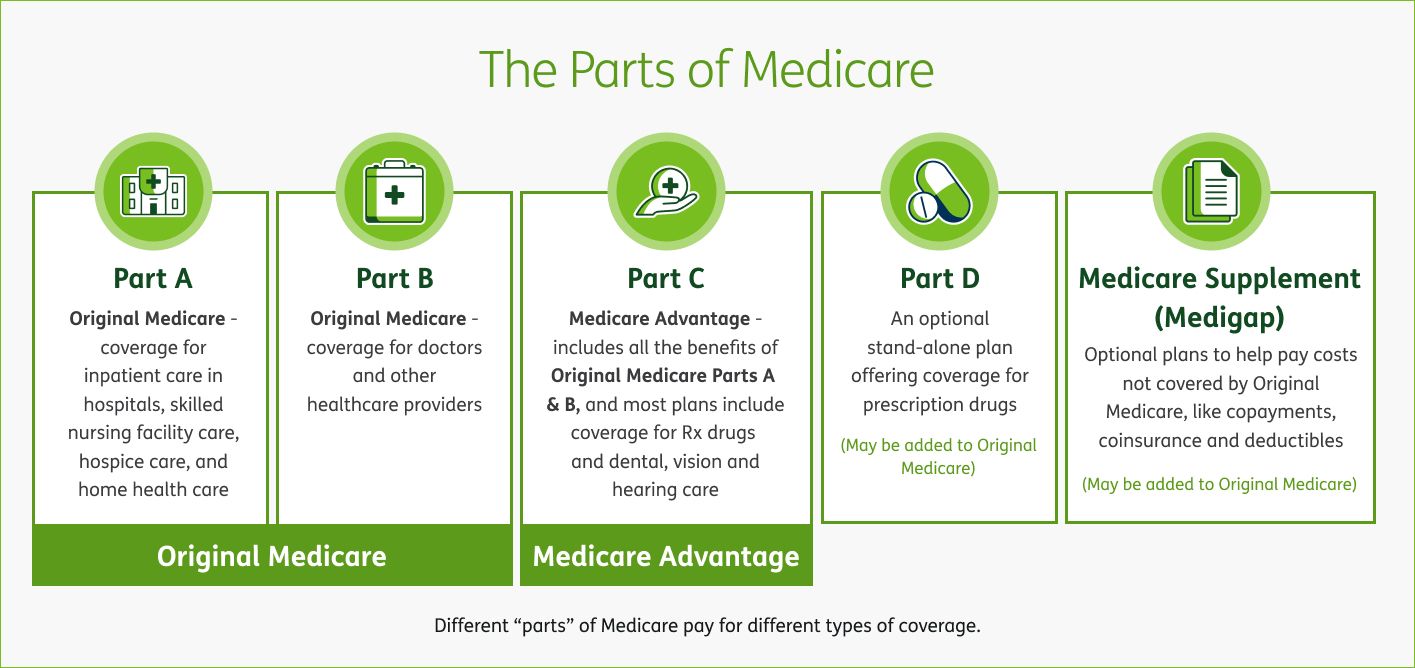

It covers Component A (health center insurance) and Part B (medical insurance coverage). This includes things that are considered medically needed, such as medical facility keeps, routine physician check outs, outpatient services and more. is Medicare insurance coverage that can be purchased straight from an exclusive health and wellness treatment company. These strategies function as an alternate to Initial Medicare while offering more benefits - Medicare South Florida.

Medicare Part D plans help cover the expense of the prescription medicines you take in the house, like your daily medicines. You can enlist in a different Part D plan to add medication insurance coverage to Original Medicare, a Medicare Price strategy or a couple of various other kinds of plans. For numerous, this is commonly the initial question thought about when browsing for a Medicare plan.

Getting My Medicare Graham To Work

To get one of the most affordable health treatment, you'll desire all the solutions you make use of to be covered by your Medicare strategy. Some covered solutions are completely cost-free to you, like going to the medical professional for precautionary care testings and tests. Your plan pays whatever. For others like seeing the medical professional for a sticking around sinus infection or loading a prescription for covered prescription antibiotics you'll pay a cost.

and seeing a supplier who approves Medicare. But what regarding taking a trip abroad? Lots of Medicare Benefit strategies provide worldwide insurance coverage, along with protection while you're traveling locally. If you plan on taking a trip, ensure to ask your Medicare consultant concerning what is and isn't covered. Possibly you have actually been with your present medical professional for a while, and you desire to keep seeing them.

The Basic Principles Of Medicare Graham

Several individuals that make the switch to Medicare proceed seeing their routine doctor, however, for some, it's not that straightforward. If you're functioning with a Medicare consultant, you can ask if your physician will certainly remain in network with your new plan. If you're looking at plans independently, you might have to click some web links and make some telephone calls.

For Medicare Advantage strategies and Price strategies, you can call the insurance provider to see to it the physicians you wish to see are covered by the plan you want. You can likewise examine the plan's internet site to see if they have an on the internet search device to find a protected physician or facility.

So, which Medicare plan should you choose? That's the very best part you have alternatives. And ultimately, the selection depends on you. Remember, when getting going, it's crucial to ensure you're as informed as feasible. Beginning with a list of considerations, make certain you're asking the right concerns and start concentrating on what kind of plan will best serve you and your requirements.

Medicare Graham Can Be Fun For Anyone

Are you ready to turn 65 and become recently eligible for Medicare? Picking a plan is a huge decisionand it's not constantly a very easy one. There are necessary things you should know in advance. The least expensive plan is not always the finest choice, and neither is the most expensive strategy.

Also if you are 65 and still functioning, it's a good idea to evaluate your options. Individuals getting Social Safety advantages when turning 65 will be automatically enrolled in Medicare Components A and B. Based on your work situation and health and wellness care alternatives, you may require to take into consideration registering in Medicare.

Think about the different kinds of Medicare plans offered. Original Medicare has two components: Part A covers a hospital stay and Component B covers medical expenses. Several people locate that Parts A and B with each other still leave spaces in what is covered, so they purchase a Medicare supplement (or Medigap) plan.

The Buzz on Medicare Graham

There is commonly a premium for Component C policies in addition to the Component B premium, although some Medicare Advantage plans offer zero-premium plans. Medicare. Testimonial the coverage details, expenses, and any kind of additional benefits provided by each strategy you're considering. If you enlist in initial Medicare (Components A and B), your premiums and coverage will be the same as various other individuals who have Medicare

Comments on “Medicare Graham for Dummies”